Advertisement

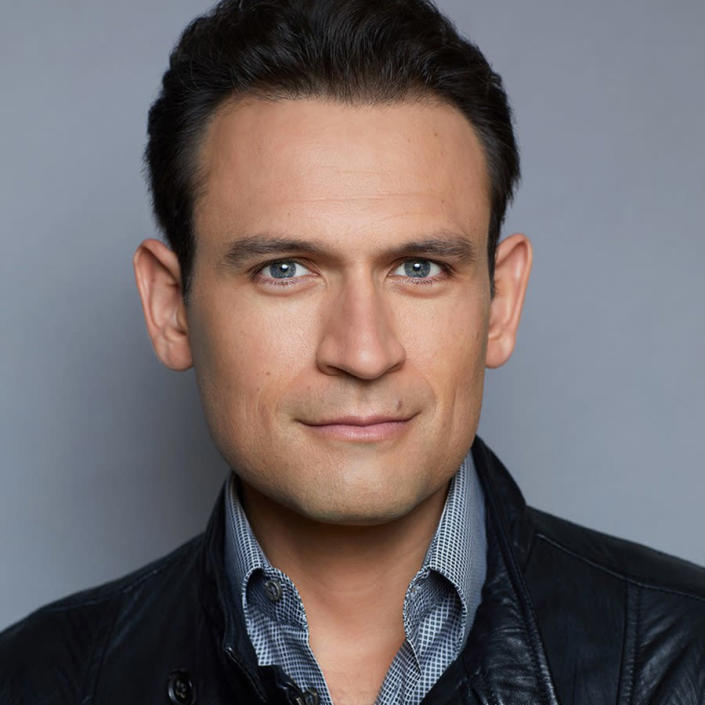

Just a few days earlier than Christmas final 12 months, Philip Martin sat in entrance of his pc to examine his cryptocurrency steadiness. It was the start of what would turn into, for him, an ongoing nightmare.

Martin advised NBC Information he thought he was typing the net tackle for his cryptocurrency trade, Coinbase, the largest and best-known firm for shoppers to retailer their digital cash. However in actual fact, he says, hackers had spoofed the url, altering it so barely that it even fooled his internet browser — which prompted him to mechanically enter his log-in and password.

The crooks now had all the data they wanted to steal his life financial savings — and so they did. Martin grew to become the most recent sufferer in what has been a wave of cryptocurrency hacks and thefts, one which specialists say raises questions on whether or not higher regulation is required.

“It’s been very irritating,” stated Martin, who’s out $165,000 price of Ethereum, a well-liked cryptocurrency. “I’ve had panic assaults.”

Martin stated he was capable of hint the place the thieves transferred his stolen crypto, given that every one Ethereum transactions are revealed on a public ledger. He contacted each native and federal legislation enforcement. However so as to add insult to harm, the FBI subject workplace in Los Angeles in the end advised him his loss was not massive sufficient to advantage investigation.

“Sadly, as a result of greenback quantity concerned in your criticism, administration has decided that it doesn’t rise to our required threshold degree and the FBI won’t be transferring ahead with an investigation presently,” wrote Particular Agent Elizabeth Hammond, in an e-mail Martin supplied to NBC Information.

Laura Eimiller, spokeswoman for the FBI’s Los Angeles subject workplace, stated she wouldn’t touch upon any particular case.

“Like with many prolific and evolving schemes, we aren’t going to arrest or prosecute our approach out of this,” she stated. “Whether or not it’s people or companies, schooling is the important thing. We urge folks to go to IC3.gov (The Web Grievance Heart) to familiarize themselves with the most recent developments.”

Martin additionally blames Coinbase, which payments itself as a “safe on-line platform for purchasing, promoting, transferring, and storing cryptocurrency.”

“Coinbase is mainly saying that they’re not accountable, and each person is accountable to safe their very own system, laptop computer or cellphone,” he stated. “These crypto exchanges don’t have any regulation that’s compelling them to be on the facet of the client and supply safety to assist in these sort of conditions that, in my view, they’re accountable for, of not offering sufficient cybersecurity on their very own URL tackle.”

A Coinbase spokesman wouldn’t touch upon the precise case, saying in an announcement that “Coinbase prospects also needs to be cautious of phishing makes an attempt and by no means click on on a hyperlink or have interaction with an e-mail that isn’t from the area Coinbase.com.”

The corporate added that “scams, fraud and different crimes can have a big influence on prospects, and we take intensive safety measures to make sure our buyer accounts stay protected. We repeatedly educate our prospects on how one can keep away from cryptocurrency scams and report identified scams to acceptable legislation enforcement authorities. We encourage all our prospects to take essential steps to securing their on-line accounts. “

The form of rip-off that befell Martin is just not the one technique by means of which shoppers have misplaced cryptocurrency. In a number of situations, crypto exchanges have been hacked. Probably the most well-known of these was the 2016 breach of Bitfinex, by means of which hackers stole Bitcoin valued just lately at an astonishing $4.5 billion. In February, the Justice Division introduced it had recovered $3.6 billion of that.

One analyst has counted not less than 46 trade hacks since 2012. The worth of the losses is tough to quantify given the fluctuation within the worth of assorted cryptocurrencies, but it surely seems to be many billions of {dollars}.

In a single current such hack, crypto buying and selling platform Bitmart pledged to make use of its personal cash to reimburse shopper losses of as a lot as $196 million.

Lawyer Urzula McCormack, a accomplice with Hong Kong-based King & Wooden Mallesons specializing in cross-border finance and expertise, says the risk image is definitely higher than it was when crypto first emerged.

“There isn’t any doubt although, that there are additionally areas the place individuals are weak,” she stated. “There’s a very vital diploma of rip-off exercise that that’s occurring. And we even have simply actually common hacking dangers that happen and actually should be guarded towards.”

In March, President Joe Biden issued an govt order designed to immediate motion amongst authorities companies to guard shoppers from crypto dangers, and dozens of payments are pending in Congress that might regulate crypto to 1 diploma or one other.

Some nations have banned adverts for crypto investments, McCormack stated, however such have been featured prominently within the U.S. throughout the Tremendous Bowl, underscoring the curiosity in crypto as an funding.

However Martin urges warning.

“I believe there’s a variety of nice potential,” he stated. “I simply suppose proper now, I personally am hesitant of investing till there’s higher shopper safety legal guidelines.”

Supply hyperlink